Emergency Gas Cards: 10 Must Know Facts

Emergency gas cards are a savior when you find yourself with an empty tank and a lack of money. They’re meant to provide instant relief in times of fuel emergency. But are they as useful as they appear?

While certain emergency gas cards actually come to the rescue, others have surprise fees or severe restrictions. Knowing the facts can save you from expensive blunders. Let’s sort out what matters most.

Table of Contents

What is an Emergency Gas Card?

An emergency gas cards are prepaid or credit-based card that allows you to purchase fuel when you run out of money. In contrast to standard fuel cards, they are meant for unforeseen circumstances. Some may be accompanied by additional features such as reload facilities, credit extensions, or roadside assistance.

Some organizations, such as Modest Needs and Salvation Army, provide emergency aid, including gas cards, at times. These schemes are a lifeline for those and families in dire need.

How to Choose the Right Emergency Gas Cards

Choosing the most suitable emergency gas cards involves more than selecting the first option within reach. The most ideal card should suit your pocket, provide room for maneuver, and save on surprise expenses. The following are the essential elements to examine while selecting an emergency gas card:

1. Compare Fees, Acceptance, and Reload Options

Not all free emergency gas cards. Some require activation fees, monthly maintenance fee, reload fee, or inactivity fee. Before enrolling, read the card’s terms and conditions or fee disclosure carefully.

Watch for:

- Activation Fee: Upfront fee to initiate use of the card.

- Monthly Fee: Repeating fee which may be applied even if the card is not used.

- Reload Fee: Certain cards charge you every time you reload funds.

- ATM Withdrawal or Balance Inquiry Fees.

Also, make sure your emergency gas card is accepted at more than one gas station. Brand-specific cards (e.g., only at BP or Chevron) exist, but others such as prepaid Visa or Mastercard are accepted at thousands of gas stations.

Reloading is just as vital. Can you reload online? With a mobile app? In a store? Cards from issuers such as Green Dot and Netspend provide reload choices at thousands of retail partners and through mobile banking.

2. Look for Cashback or Rewards

Emergency gas cards don’t necessarily have to be utilitarian—their convenient side can provide valuable rewards. Certain fuel-branded credit cards and prepaid cards include:

- Cashback on fuel buys.

- Loyalty points or fuel rebates.

- Bonus benefits for purchases with particular merchants.

For example, ExxonMobil’s Rewards+ program rewards points per gallon, and Shell’s Fuel Rewards card provides fuel savings on qualifying purchases. Although such programs are generally associated with credit-based cards, some prepaid offerings also feature limited rewards.

If you drive or commute regularly, selecting an emergency gas card that features these rewards might make your fuel dollars go even farther.

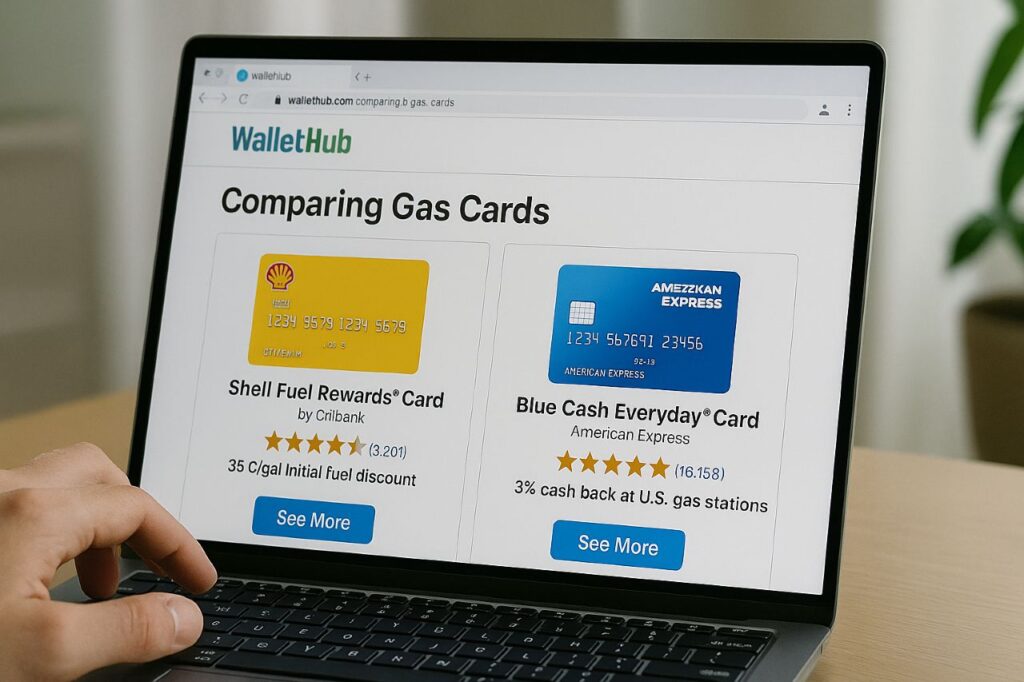

3. See Real User Reviews on Sites Such as WalletHub

Prior to investing in a particular card, observe user experience on reputable review websites. Sites such as:

These websites offer expert rating, real-user commentary, and in-depth comparison of emergency gas cards. Observe reviews that elaborate on:

- Ease of use.

- Card delivery speed.

- Concealed fees.

- Reload dependability.

- Customer service quality.

Pay attention to recent reviews, as card terms and policies can change over time. Also, avoid cards with frequent complaints about denial at gas stations, account freezes, or customer support issues.

By carefully comparing these elements, you’ll find emergency gas cards that are reliable, cost-effective, and suited to your emergency preparedness plan.

Application Process – Step-by-Step Guide

It’s easy to apply for emergency gas cards if you understand the kind of card you require—be it prepaid, credit card-based, or issued by a nonprofit organization. The process slightly differs depending on the provider of the card, but on the whole, the procedure is usually in the following steps:

Step 1: Select the Proper Kind of Emergency Gas Card

You’ll start by determining the category that best fits your requirements:

- Prepaid Cards: Excellent for people who have bad or no credit. No approval for the application is required, and funds may be added instantly. Examples are Green Dot or Netspend.

- Credit-Based Gas Cards: Call for a credit check. Some of them include Shell Fuel Rewards Card, ExxonMobil Smart Card, etc. Suitable for consumers who have good to excellent credit.

- Nonprofit-Issued Cards: Provided by charities or programs at the local government level such as Salvation Army. Perfect for individuals facing financial emergencies requiring short-term fuel support.

Step 2: Go to the Official Provider’s Website

After you’ve chosen your emergency gas card issuer, proceed directly to their official website. You can be sure to stay away from scams or third-party websites with surprise fees.

For prepaid cards, see if there is a “Get a Card” or “Sign Up” link.

For credit-based cards, go to “Apply Now” and make sure the page uses HTTPS encryption for safety.

Example links:

Step 3: Complete the Application Form

Depending on the type of card, the form will request:

- Full Name and Contact Details.

- Mailing Address (for delivery by post).

- Social Security Number (for credit-based cards).

- Income and Employment Information (credit cards only).

- Email for electronic card delivery or mobile app activation.

Prepaid cards typically only need basic information and are not credit-checked, so they are available to a wider population.

Step 4: Provide Identification and Verification

You might need to upload or verify your identity by:

- A government-issued ID (Driver’s license, Passport).

- Phone number verification by SMS.

- Bank account or debit card linking for reloading (optional for prepaid).

For nonprofit or government-issued emergency gas cards, you might also be required to provide:

- Proof of income or unemployment.

- Utility bills or rent statements.

- Explanation of financial hardship.

Step 5: Select Physical Delivery or Digital Access

After approval:

- Prepaid cards are usually mailed and take 5–10 business days to arrive.

- Some provide instant digital versions for use through mobile wallets (Apple Pay, Google Pay).

- Credit cards take longer because of credit underwriting and postal processing.

Tip: For emergency fuel assistance with immediate access, search for cards that have virtual delivery options, or find a local non-profit with in-person pickup of emergency gas cards.

Step 6: Activate and Load Funds (if applicable)

Once you receive the card:

- Prepaid cards must be activated by phone or online.

- Connect your bank account, establish direct deposit, or use retail reload points to load funds.

- Credit cards need to be activated through an online account portal and can be utilized once they are approved and confirmed.

It’s strongly advised to try your card at a local gas station prior to depending on it during a long road trip.

10 Must-Know Facts About Emergency Gas Cards

1. Emergency Gas Cards: What They Are

Emergency gas cards are financial tools designed to provide fuel access during sudden, unexpected situations—like running out of gas during travel, job loss, or natural disasters. These cards may be prepaid, credit-based, or issued through nonprofit organizations for people in financial distress.

In contrast to regular gas credit cards for continuous use, emergency gas cards are often temporary arrangements. They’re best for those who want to have immediate access to fuel without tapping into credit lines or taking out loans. Nonprofits like Modest Needs or Salvation Army, for instance, might issue such cards to low-income individuals in need.

2. Not All Emergency Gas Cards Are the Same

There are several types of emergency gas cards and knowing how they differ is crucial. Some are fuel company cards such as Shell or BP that can only be used for buying fuel at their own stations. Others are prepaid branded cards such as Visa or MasterCard that can be utilized at many fuel stations.

Fleet cards, taken by delivery motorists and gig staff, are more commonly found which are accepted through major fueling networks and contain fuel management services. The ultimate emergency gas card is one which suits your very own needs: flexibility, acceptance area, reward, and accessibility. Comparing side-by-side using tools like CardRates or WalletHub helps you do it.

3. Emergency Gas Cards Tend to Have Hidden Costs

Even though they are touted as money saviors, most emergency gas cards have all sorts of concealed charges. They come with activation fees, monthly maintenance fees, ATM withdrawal fees, reload fees, and even inactivity fees. If you do not use the card after some time, you may be charged a fee simply for having it.

Consumers must carefully read the terms and conditions before choosing one. Websites like NerdWallet regularly review and rank emergency gas cards based on transparency and fee structure. The goal is to find a card that provides value without draining your funds unexpectedly.

4. Emergency Gas Cards Can Save You During Unexpected Travel Crises

Running out of gas—particularly in far-off or rural locations—can be a harrowing and potentially hazardous occurrence. Emergency gas cards provide a financial buffer, so you can purchase fuel in an instant without cash or credit.

Most road trippers and long-distance drivers have a backup emergency gas card, preloaded with just enough balance for a full tank. Companies like WEX specialize in fuel card systems that are accepted at thousands of locations and thus can be relied upon during emergencies. Keeping one in your glove-box might be the difference between being stuck and going.

5. Some Emergency Gas Cards Need a Credit Check

While most emergency gas cards are prepaid and available to all, some—particularly those issued by fuel companies or banks—involve a soft or hard credit inquiry. Cards like the Shell Fuel Rewards or the ExxonMobil Smart Card work more like normal credit cards and usually need a good credit score.

This can be a challenge for those who experience financial instability. Fortunately, there are alternatives such as Bluebird by American Express, which provide prepaid emergency gas cards with no credit check, simple enrollment, and flexible reloading. These alternatives are best for individuals who have experienced debt recovery or unemployment.

6. Reloading Emergency Gas Cards Isn’t Always Convenient

Depending on the provider, reloading emergency gas cards may be seamless or inconvenient. Some cards allow reloads through bank transfers, mobile apps, or direct deposit. Others require visiting specific retail locations like Walmart or CVS.

Convenient options like Netspend and Green Dot have multiple reload points across the country and mobile app capability, which is more suitable for emergencies. Ensure that you opt for a reload flexibility card according to your lifestyle and accessibility requirements.

7. Acceptance Can Be Limited by Location or Brand

One crucial aspect that is often neglected is acceptance. Most emergency gas cards are affiliated with one fuel chain, be it Chevron or BP. This can become a huge hassle if you happen to be in a region where that brand doesn’t have an operation.

Prepaid Visa or MasterCard-branded emergency gas cards usually provide the most widespread acceptance and can be accepted at almost every station. Check compatibility maps published on websites such as CardRates or utilize the provider’s own locator tool prior to selecting an emergency gas card to confirm extensive regional coverage.

8. Rewards and Cashback are Provided with Some Emergency Gas Cards

You don’t have to forsake rewards just because you’re managing emergencies. A number of emergency gas cards, especially those that are tied to branded credit lines, reward you with such benefits as cashback, loyalty points, or fuel savings. For example, ExxonMobil gives up to 6 cents off per gallon and bonus points on transactions.

This also makes emergency gas cards a practical long-term resource, too, particularly for frequent drivers. Look for cards with a combination of reliability and added-value benefits.

9. Emergency Gas Cards Assist You in Managing Fuel Expenses

If you are trying to budget, prepaid emergency fuel cards are a good idea. They enable you to set a specific amount to use for gas each week or month. This type of spending control keeps you from spending too much and lets you see where your fuel money is going.

Parents can use them for teen drivers, while gig and ride-share workers fill them to cap weekly business costs. The obvious distinction between fuel money and ordinary bank accounts simplifies budgeting and discourages overspending on other things.

10. They Should Not Be Your Long-Term Fuel Plan

Emergency gas cards play an essential short-term function, but they shouldn’t be your long-term fuel plan. Using them every day could mean that there are underlying financial problems, like inadequate budgeting, income volatility, or no savings.

If you’re constantly requiring emergency gas cards, it’s worth consulting with a nonprofit counselor at NFCC to create a long-term financial strategy. These cards need to be considered a last resort—not a solution—to ongoing financial shortfalls.

Emergency Gas Cards vs. Gas Credit Cards

When deciding between emergency gas cards and gas credit cards, it’s important to look at your spending patterns, credit score, and frequency of buying fuel. Although both are accepted at fuel stations, they serve different purposes, have varying structures, and offer different advantages.

Emergency Gas Cards:

Made for temporary usage, particularly for financial emergencies or unplanned travel requirements.

- Often prepaid, which implies you load the funds before using them.

- No credit check necessary, so they’re great for individuals with bad or no credit.

- Good for budgeting — you can’t spend more than what’s loaded.

- Tend to be limited in rewards but easy to get and maintain.

Gas Credit Cards:

Designed for frequent drivers who want to earn fuel rewards or establish credit.

- Need a good to excellent credit rating for approval.

- Provide rewards such as cashback, fuel savings, or loyalty points.

- May include interest charges if balances are not paid off monthly.

- Often have higher limits and can be used beyond just gas purchases.

If you’re unsure which option is best, use Bankrate to compare terms, interest rates, and approval requirements. Emergency gas cards offer instant, controlled help, gas credit cards reward consistency and strong credit behavior.

Tips to Use Emergency Gas Cards Wisely

To get the best out of your emergency gas cards, it’s best to spend them wisely and on purpose. The following are some handy tips to heed:

Spend Only in Genuine Emergencies

Resist the urge to charge your regular fuel costs on your emergency gas card. These cards are meant to be saved for actual emergencies, such as running out of money with no cash or having a short-term financial crisis. Charging them up too frequently will drain their functionality when you really need them.

Reload Cautiously and Track Usage

As prepaid emergency gas cards often come with reload fees or have a maximum daily reload capacity, be cautious when reloading. Top up only as much as you require, and always monitor usage via the mobile app or web dashboard. This keeps spending in check and means you won’t ever find yourself surprised with a low balance.

Store It Safe for Travel

Use your emergency gas card like a first-aid kit — always on hand but only employed when needed. Store it in a safe place in your car or wallet, so it’s ready for that surprise trip or road trip. Just be sure to activate it and have a balance beforehand.

These habits allow your emergency gas card to fulfill its function without unwanted fees or abuse.

Common Mistakes to Avoid

Even the most excellent emergency gas cards can be annoying if used incorrectly. The following are some of the most common errors to avoid:

Overlooking Hidden Charges

Most customers forget to read the fine print when they apply for emergency gas cards. Activation, reload, monthly, and inactivity charges add up very fast. Always read the terms carefully and utilize review sites such as NerdWallet to identify hidden fees.

Selecting Cards with Bad Acceptance

Not all emergency gas cards are widely accepted. Some only work with specific fuel brands, which can be inconvenient if you’re traveling or living in an area with limited gas station options. Always check the card’s acceptance network in advance.

Forgetting to Activate or Reload in Time

An emergency gas card does not work if it’s not activated or not having a balance. Most users don’t activate their cards in advance or think it will be available to use right away. Always activate your card and have a small balance available for actual emergencies.

Staying clear of these traps keeps your emergency gas cards in working condition when you need them most.

Real-Life Success Stories

Emergency gas cards have helped countless individuals avoid stressful and potentially dangerous situations. Here are a few examples from real users found on blogs, forums, and Reddit:

Salvation Army Rescues Stranded Seasonal Workers in Alaska

The Salvation Army of Alaska runs a travel aid program that offers emergency assistance, such as gas vouchers, to stranded seasonal workers. For example, Michael, a seasonal employee who lost his job and his housing, was helped back home to Oklahoma. The program assesses individual needs and can book transport within a day. Since 2022, 37 people have been assisted by this program.

South African Gas Station Attendant’s Goodness

A gas station attendant at Shell in Cape Town, South Africa, Nkosikho Mbele, paid for a woman’s fuel when she discovered she had forgotten her bank cards at home. His good deed saved her from being stranded on a dangerous road. Touching by his goodness, the customer initiated a fundraising campaign that raised R500,000 (nearly eight years’ worth of salary) for Mbele.

United Way Offers Gas Cards to Medical Appointments

United Way of Southwest Michigan, in conjunction with Berrien County Cancer Services, provides patients requiring transportation for medical appointments with gas cards. This support has been invaluable to people such as Greg, who needed to visit Grand Rapids often for treatment, so they might make necessary appointments without financial difficulties.

Conclusion

Emergency gas cards are an effective money safety net when used properly. Whether you need to handle a surprise travel emergency, job loss, or merely be prepared for anything, the cards provide instant fuel access without resorting to conventional credit.

However, like any financial tool, emergency gas cards must be chosen and managed wisely. Understanding the fees, acceptance, and reload options can make all the difference. With the right card in hand, you’ll not only avoid getting stranded but also gain peace of mind during life’s unpredictable moments.

Read: Liberty Gas Card: 5 Powerful Benefits You’ll Love

Frequently Asked Questions

Can I get emergency gas cards with no credit?

Yes, many prepaid emergency gas cards do not require a credit check. These are ideal for individuals with poor or no credit history and can be activated immediately after purchase.

How fast can I receive it?

Some emergency gas cards offer instant digital delivery, which you can use immediately via a mobile wallet. Physical cards typically arrive within 5–7 business days, depending on the provider.

Are emergency gas cards accepted at all gas stations?

No. Many emergency gas cards are brand-specific (e.g., Shell, BP), while others are prepaid Visa/Mastercard-based and accepted at most major fuel retailers. Always check the acceptance network before use.

Can I use emergency gas cards for other purchases?

Most emergency gas cards are fuel-only, but some may allow small purchases like snacks or drinks at gas station convenience stores. Be sure to read the card’s usage terms.

What fees should I watch out for with emergency gas cards?

Common fees include activation, reload, monthly maintenance, and inactivity fees. Always read the fine print to avoid unexpected charges and choose cards reviewed on platforms like NerdWallet.

Can I reload my emergency gas card anywhere?

Reloading options depend on the provider. Some allow online or mobile app reloads, while others require in-store reloads at partner retailers. Look for cards with flexible options from providers like Netspend or Green Dot.

Are emergency gas cards better than gas credit cards?

It depends on your needs. Emergency gas cards are ideal for short-term use and budgeting, while gas credit cards offer long-term benefits and rewards but require good credit and may charge interest.

One Comment