Unicare Gas Card Review: 7 Reasons Drivers Love It

Unicare gas card is a useful program provided by UniCare Health Plan of West Virginia to help transport Medicaid members by covering transportation expense. Qualified families can get gas cards worth a maximum of $100 per year, given quarterly in the amount of $25, to reimburse costs associated with traveling to doctor’s appointments and receiving necessary services. The objective of this activity is to make transportation less prohibitive and bring about improved member health outcomes.

In this piece, we’re going to analyze the major benefits of the Unicare gas card, the conditions for eligibility, how to apply, and maximizing its benefits. Knowing how this program operates, members can use the assistance on offer to its fullest potential.

Table of Contents

7 Powerful Reasons It Outperforms Competitors

1. Financial Assistance for Transport Fees

Reduces the Financial Burden of Travel Arrangements

Transportation is still one of the most neglected yet essential hurdles to healthcare access in the United States. For poor individuals and families, paying for gas for frequent hospital or clinic visits is highly difficult. The Unicare gas card offers sorely needed economic assistance by reimbursing some of the costs of fuel so that members may travel to their medical appointments without financial anxiety. This assistance assists in bridging the chasm between access and affordability to healthcare.

Indeed, as the National Academies of Sciences reports, transportation obstacles lead to postponed or for-gotten medical treatment for millions annually. Resources such as the Unicare gas card are even more worthwhile when combined with more extensive coverage plans such as United Homes Insurance, which not only safeguards one’s home and assets but also frequently features ancillary benefits tied to health and wellness resources.

Facilitates Routine Healthcare Visits

Encourages Ongoing Preventive Care

When gas money is no longer an issue, patients are more likely to keep appointments, particularly for ongoing conditions such as diabetes, hypertension, or heart disease. The Unicare gas card ensures people don’t miss preventive care, lab tests, or regular treatments because they don’t have gas money.

This reliability is crucial to early diagnosis and long-term health. A study by the American Journal of Public Health revealed that transportation shortage is directly related to higher emergency room visits. By facilitating ongoing outpatient care, the Unicare gas card can indirectly contribute to lowering emergency healthcare expenditures — an objective that resonates well with the objectives of comprehensive plans like United Homes Insurance, which typically incentivize policyholders for taking preventive care practices.

In addition, most home and health package providers, such as United Homes Insurance, are now venturing into added-value services such as wellness benefits, telemedicine coverage, and even alliances with transportation assistance programs. This holistic solution guarantees families with assistance both in the home and on the road to health.

2. Promotes Preventive Care and Wellness

Incentivizes Check-Ups and Health Screenings

Preventive care is one of the most cost-efficient ways to enhance public health, but it is not used as much because of transportation and financial barriers. To remedy this, Unicare’s Healthy Rewards Program offers concrete rewards for members who engage in proactive health management. These include annual check-ups, vaccinations, and health screenings. When combined with the Unicare gas card, members not only get financial assistance for transportation but also receive reward points for participating in these visits.

Preventive services can lower the risk of diseases like cancer, diabetes, and cardiovascular disease by a great extent, according to the Centers for Disease Control and Prevention (CDC). Reward programs for such behavior not only encourage improved health outcomes but also complement comprehensive coverage solutions like United Homes Insurance. Most full-coverage home insurance policies are now incorporating wellness benefits, providing discounts or incentives to policyholders who participate in preventive healthcare measures.

Encourages Long-Term Health Gains

Preventive health behavior—such as routine screenings and wellness visits—enables early identification of possible health issues, which in turn results in quicker, less expensive treatment. The Unicare gas card is instrumental in facilitating these preventive visits for individuals with limited transportation access, directly enhancing long-term health.

This type of health-conscious support mirrors the wider goal behind initiatives such as United Homes Insurance, which more and more acknowledge the correlation between domestic stability and personal health. Through their bundled coverage of property and aspects of health protection, these companies are changing the way we perceive holistic care. For example, some insurers now reward policyholders with incentives who regularly go for health check-ups or have a preventive maintenance regimen.

Conjoined, the Unicare gas card and United Homes Insurance create a solid corner for members to place the spotlight on health without being bogged down by daily monetary challenges. It’s an intelligent, progressive strategy that caters to the health and the home.

3. Streamlined Application and Redemption Process

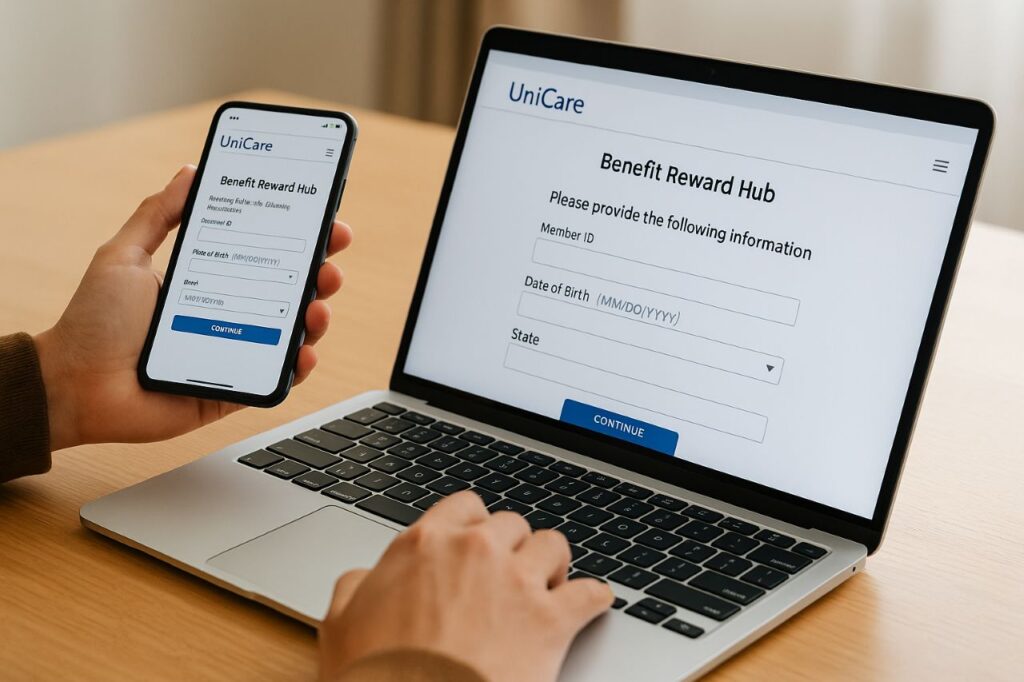

Streamlined Registration through the Benefit Reward Hub

Applying for transportation benefits should be as easy as possible—particularly for those already dealing with health issues. That’s why Unicare made it easier through its Benefit Reward Hub, found online at unicare.com/wv. The online portal makes it simple for qualified members to apply for the Unicare gas card in mere clicks, allowing them to easily start receiving the assistance they deserve.

Online accessibility is particularly vital for low-income families or those in rural locations, where going to in-person enrollment centers may be challenging. The convenience of applying at home reflects the user-centrist strategy employed by most home insurance companies, such as United Homes Insurance, with its streamlined online application and claims process. These dual systems favor ease and efficiency in order to deliver benefits with the least possible delay.

Convenient Redemption at Participating Locations

After approval, members are issued their Unicare gas cards, which they can redeem at a wide network of participating fueling stations. This convenience is critical—it frees users from having to use a particular brand or limited number of locations. Rather, they can select from several nearby gas stations, making it simpler to reach medical appointments or necessary errands without extra hassle.

Such convenience is very much in line with the service ethic of United Homes Insurance, an insurer that has a mission of providing flexible, customizable coverage combined with adaptable support services. Be it selecting the local repair firm following damage to property or a health-related add-on, customers enjoy customized solutions that suit the rhythms of daily life. Insurance platforms even bring transportation support and emergency services to their wellness plans, making healthcare more accessible as well as stability at home.

Together, the Unicare gas card and initiatives such as United Homes Insurance contribute to a more accessible, health-oriented support network—one that does not merely respond to emergencies but actively prevents them by eliminating barriers to necessary services.

4. Integration with Other UniCare Benefits

Supplements Additional Support Programs

Unicare gas card is not an individual benefit—it’s one of many considerate services aimed at advancing the general well-being and health of members. Besides fuel discounts, Unicare provides programs covering personal hygiene supplies, baby products such as wipes and diapers, and wellness initiative participation. With these services packaged together, members are not only assisted with transportation but also general daily needs.

For example, programs like Aetna Better Health have adopted similar integrated benefit structures that combine medical, nutritional, and lifestyle support under one plan. Similarly, United Homes Insurance is evolving beyond traditional home coverage to offer optional wellness-focused perks such as health counseling services, safety device discounts, and home fitness benefits. This trend in integrated care and coverage fosters a more complete support ecosystem for both health and home.

Improves Overall Member Experience

When members are provided with multiple forms of support—transportation, wellness tools, household essentials—it enhances both quality of life and health outcomes. The combination of the Unicare gas card and other programs of assistance creates a more cohesive and supportive experience, with members feeling understood and cared for at all levels.

This type of integrated member care also mirrors the increasing focus in the insurance industry on experience and value. Insurers such as United Homes Insurance are moving their attention towards total policyholder satisfaction, combining proactive services and online platforms to increase interaction. As reported by the National Association of Insurance Commissioners (NAIC), providing bundled and value-added services has emerged as a top driver of customer retention and overall satisfaction.

By linking transportation assistance to general wellness and household assistance, Unicare is establishing a benchmark in member-focused care—something that appeals to the holistic approach to United Homes Insurance as well.

5. Targeted Assistance to Special Populations

Support for Pregnant and New Mothers

Healthcare access is particularly important during pregnancy and postpartum care. Acknowledging this, Unicare offers specific support to pregnant women and new mothers in the form of baby essentials gift cards, safe sleep kits, and other wellness resources. These are also supplemented by the Unicare gas card, which assists in covering transportation to prenatal visits, birthing classes, and postnatal visits—providing ongoing and timely care for both mother and infant.

Initiatives such as CHIP (Children’s Health Insurance Program) highlight the significance of prenatal care in minimizing infant mortality and enhancing early childhood development. Transportation assistance can be the difference between lost care and healthy outcomes. Concurrently, United Homes Insurance is among an increasing number of insurers venturing into family-centered add-ons—such as home safety devices, nursery safeguards, and wellness advice for new parents—highlighting a focus on health beyond home coverage.

Care Coordination for Chronic Conditions

Those suffering from diseases like diabetes, hypertension, and asthma need routine monitoring and upkeep. Through the Unicare gas card, its members who battle these conditions are able to be able to keep going to regularly scheduled doctor checkups, grab medications, and participate in education sessions related to their condition. Ongoing care coordination is key to avoiding complicating factors as well as emergency room visits and, ultimately, an improved standard of living.

Regular check-ups and compliance with care plans significantly minimize the risk for long-term complications, as identified by the American Diabetes Association. However, transportation is a limitation for many. Closing the gap, the Unicare gas card gives members the power to continue being involved with their healthcare experience.

Likewise, United Homes Insurance acknowledges that home health stability is vital to chronic illness management. Certain home insurance policies now provide support tools for individuals with chronic illness—such as medical equipment damage coverage, emergency services, or collaborations with telehealth providers—bridging a gap between personal wellness and property protection.

In combination, the Unicare gas card and United Homes Insurance provide effective, targeted assistance to those who require it most—completing a full spectrum safety net of both healthcare and home needs.

6. Positive Impact on Health Outcomes

Reduces Missed Appointments

Missed medical appointments are a significant public health issue, frequently leading to deteriorated conditions, delayed diagnoses, and higher healthcare expenditures. The National Library of Medicine states that lack of transportation is one of the primary reasons for appointment no-shows, particularly among low-income and rural groups. The Unicare gas card specifically addresses this by paying for fuel, allowing members to keep their scheduled medical appointments without incurring financial hardship.

This enhanced appointment keeping can result in early detection of illnesses, timely interventions, and decreased emergency room use. Just as United Homes Insurance safeguards families against financial strain after home-related accidents, the Unicare gas card offers a buffer against medical accessibility disruptions, ensuring transportation expenses don’t interrupt essential care routines.

Fosters Participation with Healthcare Professionals

Recurrent contact with healthcare providers encourages stronger communication, improved diagnosis, and more tailored treatment plans. The Unicare gas card gives members the ability to be an active participant in their own health process by eliminating the logistical hindrance of transportation. This repeated access establishes trust between patients and providers and allows for more efficient long-term care planning.

Studies by Health Affairs indicate that more active patients are more likely to follow treatment regimens and experience improved health outcomes. Just as United Homes Insurance fortifies a family’s foundation by providing comprehensive coverage and responsive care, the Unicare gas card fortifies the healthcare experience by encouraging consistent, unbroken provider interaction.

Collectively, these programs show the worth of breaking down barriers—physical, financial, or informational—to provide improved results and peace of mind overall for members and policyholders.

7. Increases Member Engagement and Retention

Deepens the Member-Plan Connection

The Unicare gas card is more than a financial assistance solution—it’s an effective engagement tool. By offering useful, day-to-day support such as fuel help, Unicare is making it clear that it listens and cares about members’ actual-life situations. That perception of caring creates emotional connection, loyalty, and trust, which ultimately leads to a deeper, long-term connection between member and health plan.

As per Forrester Research, when health insurance companies address members’ practical and emotional needs, satisfaction and retention rates go up substantially. Likewise, United Homes Insurance follows this approach by merging basic home protection with value-added services such as home safety advice, disaster recovery manuals, and home wellness kits—establishing trust that extends beyond coverage.

By placing a focus on practical applicability, both Unicare and United Homes Insurance demonstrate that they are not merely service providers but partners in day-to-day living.

Fosters Regular Plan Utilization

As members utilize the Unicare gas card on a regular basis, they become more comfortable and aware of discovering other plan amenities. This consequently results in greater utilization of services like preventive testing, behavioral health initiatives, telehealth visits, and health education materials.

The more integrated the experience, the more members remain informed, healthier, and content. For example, members who pair the gas card with other Unicare incentives—such as baby product rewards, dental care kits, or fitness monitors—derive the greatest value from their plan. This type of proactive use builds a feedback loop of engagement and wellness.

Insurers such as United Homes Insurance have also experienced the same trends. Policyholders who use additional services—such as smart home discounts or weather damage notices—are much more likely to renew and refer their policies to others, based on statistics from Insurance Information Institute. These additions support retention while providing real value.

Ultimately, Unicare gas card and United Homes Insurance have the same aim: to provide greater than standard protection by establishing a joined-up, enhanced experience that enhances quality of life and member satisfaction.

Conclusion

The Unicare gas card is not just a transportation benefit—it’s a lifeline for West Virginia Medicaid members, giving them the ability to receive vital healthcare services without the added expense of fuel. By removing one of the most prevalent obstacles to care, Unicare allows its members to focus on their health through routine checkups, preventive screenings, and continued treatment for chronic illnesses.

As evidenced by Kaiser Family Foundation reports, access to reliable transportation is a key to better health outcomes, particularly for at-risk populations. The Unicare gas card directly meets this need, facilitating members’ ability to get to appointments and fully interact with their care teams.

Members are encouraged to visit the Benefit Reward Hub to apply for the gas card and review the additional support programs that are available. Through this, not only do they attain transportation assistance, but they also gain access to a complete spectrum of Unicare benefits—ranging from baby care kits to wellness incentives—that result in a healthier lifestyle.

This effort resonates with the wider purpose observed in initiatives such as United Homes Insurance, which go beyond standard policies to encompass well-being upgrades and customer-focused tools. As United Homes Insurance provides peace of mind through property and lifestyle covers, Unicare provides security and stability by investing in the health and daily needs of its members.

Together, these programs illustrate a movement toward integrated care—where home, health, and well-being are all included in the same equation.

Take action today: Apply for the Unicare gas card, take control of your healthcare journey, and see how bundled services like United Homes Insurance can help with every part of your well-being.

If you’re exploring more fuel card options, the Speedway Business Gas Card: 7 Powerful Reasons It’s Worth It is another valuable program designed for businesses and fleets. It offers volume-based discounts, detailed expense tracking, and control features that help businesses manage fuel costs efficiently. Whether you’re a small business owner or managing a fleet, this card delivers financial and operational benefits worth considering.

Frequently Asked Questions (FAQs) – Unicare Gas Card

What is the Unicare gas card?

The Unicare gas card is a transportation assistance benefit provided to eligible UniCare Health Plan of West Virginia Medicaid members. It helps cover fuel costs for attending approved medical appointments and healthcare-related activities.

Who is eligible for the Unicare gas card?

Eligible members are typically enrolled in UniCare’s Medicaid program in West Virginia. Specific eligibility may depend on participation in UniCare’s wellness or Healthy Rewards programs. You can confirm eligibility by contacting UniCare or visiting unicare.com/wv.

How much money is provided on the gas card?

Members can receive up to $100 per year, distributed as $25 each quarter (every three months), depending on their engagement with healthcare services and activities.

How can I apply for the Unicare gas card?

You can apply or redeem your reward by visiting the Benefit Reward Hub at www.mybenefitrewardhub.com or calling the number listed on the back of your UniCare member ID card.

Where can I use the Unicare gas card?

The gas card can be used at participating fuel stations across West Virginia and nearby areas. Details of accepted locations are provided when you receive the card or via UniCare’s member services.

How often can I receive the gas card?

The reward is typically issued once every quarter, depending on whether you meet certain health-related requirements (e.g., attending a check-up, screening, or completing a health survey).

Can I combine the gas card with other UniCare rewards?

Yes! UniCare members often receive multiple types of rewards including gift cards for baby items, dental kits, and more. The gas card can be combined with these for broader health support.

What should I do if I lose my gas card?

If your gas card is lost or not received, contact UniCare member services as soon as possible to request a replacement or resolve the issue.

One Comment